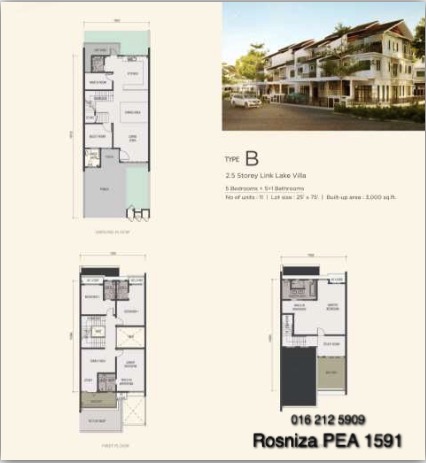

Hening Terrace House For Sale Presint 16 Putrajaya

CARA PENGIRAAN KELAYAKAN PINJAMAN BANK

Sebelum anda membeli rumah pastikan anda periksa dahulu kelayakan pinjamanan yang boleh anda mohon. Selain daripada minta nasihat pihak bank anda juga boleh membuat pengiraan sendiri supaya anda dapat merancang nilai rumah yang boleh anda beli dan memudahkan pinjaman anda lulus. Ini adalah langkah-langkah pengiraan pinjaman bank untuk anda:

1- Kira Pendapatan Bersih

2- Kira Had Maksima DSR (Debt Service Ratio)

3- Net Disposable Income (NDI)

4- Kira Kelayakan Komitmen Baru

5- Kira Harga Rumah Maksima

#1 KIRA PENDAPATAN BERSIH

- PENDAPATAN (INCOME) – PENOLAKAN (DEDUCTION) = PENDAPATAN BERSIH (NET INCOME)

PENDAPATAN (INCOME)

- Gaji Tetap

- Elaun Tetap

- Elaun tidak tetap*

- Proxy Income

– Dividen ASB

– Dividen TH

– Sewaan*

– Komisen*

*Mungkin tidak diambil pada nilai 100%

[-] PENOLAKAN (DEDUCTION)

- KWSP/EPF

- PERKESO/SOCSO

- Cukai/PCB

- Zakat

[=] PENDAPATAN BERSIH (NET INCOME)

- PENDAPATAN – PENOLAKAN = PENDAPATAN BERSIH

#2 KIRA HAD MAKSIMA DSR (DEBT SERVICE RATIO)

- PENDAPATAN BERSIH (NET INCOME) x KADAR PERATUS DSR = HAD MAKSIMA DSR

PENDAPATAN – PENOLAKAN = PENDAPATAN BERSIH

[x] KADAR PERATUS DSR

- 40% – 85%

- Kadar peratusan DSR berbeza antara individu, bergantung kepada

– Bank

– Pendapatan Bersih

HAD MAKSIMA DSR

- Had maksima DSR ini termasuk

– Komitmen sedia ada

– Komitmen baru

#3 NET DISPOSABLE INCOME (NDI)

- NDI ialah amaun yang bank tetapkan perlu ada pada pemohon sebagai kos sara hidup. Kebanyakan bank ambil NDI pada julat RM 1,000 – RM 1,500, bergantung kepada bank, tempat tinggal dan lain-lain.

- Kadar peratus DSR akan dipengaruhi oleh NDI, contohnya jika NDI ialah RM1,000:

Gaji Bersih RM 3,000

- DSR 70% = RM 2,100 – Had maksima DSR asal

- Baki 30% = RM 900 – tak lepas NDI RM 1,000

- Adjusted DSR: RM 3000 – RM 1,000 = RM 2,000 – had maksima DSR baru 66.67%

#4 KIRA KELAYAKAN KOMITMEN BARU

- HAD MAKSIMA DSR – KOMITMEN SEDIA ADA = KELAYAKAN KOMITMEN BARU

HAD MAKSIMA DSR

- Had maksima DSR termasuk komitmen sedia dan komitmen baru

- Perlu ambilkira tentang NDI seperti langkah 3

[-] KOMITMEN SEDIA ADA

- Pembiayaan Peribadi (Personal Loan)

- Pembiayaan ASB

- Pembiayaan Kenderaan

- Kad Kredit

- Pembiayaan Koperasi

- ANGKASA

- Dan lain-lain

[=] KELAYAKAN KOMITMEN BARU

- Kelayakan ansuran bulanan untuk pembiayaan perumahan yang baru

#5 KIRA HARGA RUMAH MAKSIMA

- KELAYAKAN KOMITMEN BARU x PEMALAR (CONSTANT) = HARGA RUMAH MAKSIMA YANG LAYAK DIBIAYAI

KELAYAKAN KOMITMEN BARU

- Kelayakan ansuran bulanan untuk pembiayaan perumahan yang baru

[x] PEMALAR

- 200 dengan andaian berikut:

– Kadar efektif 4.5%

– Tempoh Pembiayaan 35 tahun

[=] HARGA RUMAH MAKSIMA YANG LAYAK DIBIAYAI

- Bagi andaian kasar efektif 4.5% dan tempoh pembiayaan 35 tahun, bagi setiap kelayakan ansuran baru RM 500, harga rumah maksima yang layak ialah RM 100,000.

- Ansuran RM 500

– Harga rumah RM 100,000

#CONTOH 1 (CUKUP NDI)

PENDAPATAN: GAJI (RM 3,000) + ELAUN TETAP (RM 1,000) = RM 4,000

[-] PENOLAKAN: KWSP (RM 240) + SOCSO (RM 20) + ZAKAT (RM 50) = [-] RM 310

#1 PENDAPATAN BERSIH = RM 3,690

#2 HAD MAKSIMA DSR

- 40% x RM 3,690 = RM 1,476

- 85% x RM 3,690 = RM 3,137

Andaian bank tersebut menggunakan kadar peratus DSR 60%

- 60% x RM 3,690 = RM 2,214

- Baki 40% = RM1,476

#3 NDI

- RM 1,000 – CUKUP (rujuk baki 40% melebihi RM1, 000)

Komitmen Sedia Ada: Tiada

#4 KELAYAKAN KOMITMEN BARU

- RM 2,214 – 0 = RM 2,214

#5 HARGA RUMAH MAKSIMA YANG LAYAK DIBIAYAI

- RM 2,214 x 200 = RM 442,800

#CONTOH 2 (TAK CUKUP NDI)

PENDAPATAN: GAJI (RM 2,000) + ELAUN TETAP (RM 500) = RM 2,500

[-] PENOLAKAN: KWSP (RM 160) + SOCSO (RM 12) + ZAKAT (RM 10) = [-] RM 182

#1 PENDAPATAN BERSIH = RM 2,318

#2 HAD MAKSIMA DSR

Andaian bank tersebut menggunakan kadar peratus DSR 60%

- 60% x RM 2,318 = RM 1,390

- Baki 40% = RM927

#3 NDI

- RM 1,000 – TAK CUKUP

- ADJUSTED DSR: RM 2,318 – RM 1,000 = RM 1,318 (56.9% DSR)

KOMITMEN SEDIA ADA: Tiada

#4 KELAYAKAN KOMITMEN BARU

- RM 1,318 – 0 = RM 1,318

#5 HARGA RUMAH MAKSIMA YANG LAYAK DIBIAYAI

- RM 1,318 x 200 = RM 263,600 – Gaji RM 2,500